FreshBooks vs QuickBooks: Which Invoicing Software Will Actually Help You Get Paid on Time?

Can’t decide between FreshBooks and QuickBooks? Learn which invoicing software is better for freelancers worried about late payments, confusing finances, and staying organized.

Have you ever felt a wave of anxiety when you send an invoice—wondering if your client will pay you on time, or at all? Or struggled to keep track of expenses, reminders, and paperwork while juggling projects? If you’re a freelancer, you’re not alone.

Late payments and invoicing chaos are among the biggest sources of stress for freelancers. That’s why choosing the right invoicing software isn’t just a business decision—it’s peace of mind.

Two of the most popular options in 2025 are FreshBooks and QuickBooks, but each is built with different strengths. So how do you know which one will actually help you sleep better at night?

This complete comparison guide will walk you through what each software does best, where they fall short, and exactly how they stack up in the areas that matter most—so you can make the best choice for your freelance business.

Overview: Who Are FreshBooks and QuickBooks Really For?

FreshBooks was designed specifically with freelancers and small service businesses in mind. Its clean interface, customizable invoices, and intuitive features make it feel like it’s holding your hand through every step of the invoicing process—without overwhelming you with accounting jargon.

QuickBooks is better known for its powerful accounting tools, making it ideal for freelancers who expect to grow into a multi-person business or who need in-depth reports for taxes, bookkeeping, or investor meetings.

StackPen’s Tip: Don’t feel pressured into complicated software if you don’t need it—your invoicing tool should make your life easier, not harder.

Pricing and Plan Differences: What Will It Really Cost You?

| Feature | FreshBooks | QuickBooks |

|---|---|---|

| Starting Price | Lite: ~$19/month | Self-Employed: ~$25/month |

| Higher Plans | Plus: ~$33/moPremium: ~$60/mo | Simple Start: ~$30/moPlus/Advanced tiers |

| Free Trial | 30 days | 30 days |

| Best For | Freelancers needing easy invoicing & reminders | Freelancers who need invoicing + robust accounting |

| Invoice Customization | Highly customizable, modern templates | Customizable, but designed for integration with accounting |

| Recurring Invoices & Reminders | Easy to set up, beginner-friendly | Available, but with more complex setup |

| Expense Tracking | Basic expense tracking | Full accounting features: expenses, taxes, reports |

| Mobile App | Simple, focused on invoicing & time tracking | Comprehensive accounting tasks, including mileage |

| Ease of Use | Very beginner-friendly, intuitive interface | Steeper learning curve |

| Scalability | Best for solo freelancers or small teams | Better for growing into small businesses or agencies |

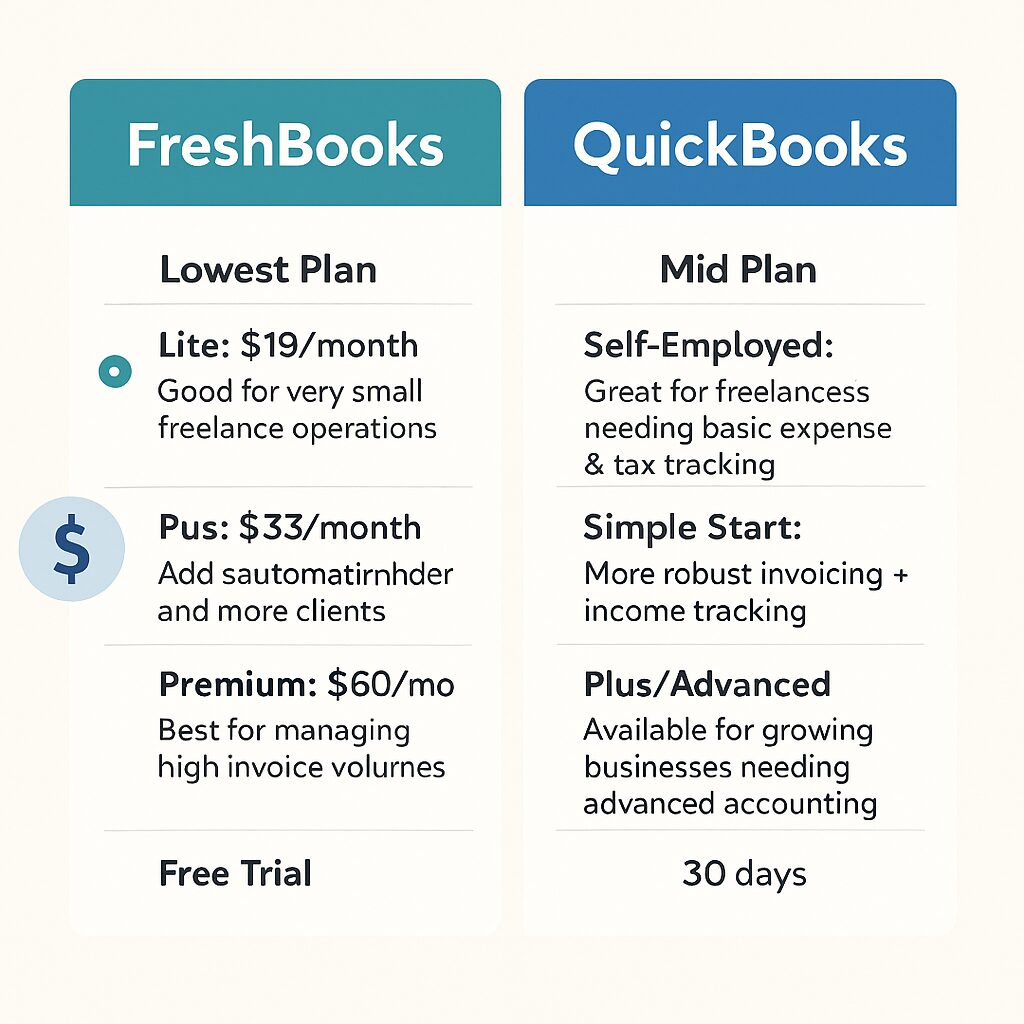

FreshBooks Pricing

- Lite: ~$19/month — good for very small freelance operations

- Plus: ~$33/month — adds automated reminders and more clients

- Premium: ~$60/month — best if you’re managing a high volume of invoices

- 30-day free trial

QuickBooks Pricing

- Self-Employed: ~$25/month — great for freelancers who want to track expenses & taxes

- Simple Start: ~$30/month — more robust invoicing + income tracking

- Higher tiers (Plus/Advanced) for growing businesses

- 30-day free trial

FreshBooks tends to cost less if you’re just getting started and only need essential invoicing. But QuickBooks’ higher plans offer more if you need deeper accounting features down the road.

Invoicing Features: How Do They Compare?

Invoice Customization and Templates

FreshBooks stands out with beautifully designed, easy-to-personalize invoice templates. You can add your logo, brand colors, and notes, so clients know they’re dealing with a professional.

QuickBooks allows solid customization, but its focus on accounting means it doesn’t feel quite as effortless if you’re only interested in invoicing.

Recurring Invoices and Payment Reminders

Both tools

- Recurring invoices for clients on monthly retainers

- Automated email reminders to chase late payments

…but FreshBooks makes these features easier to find and set up—perfect if you’re new to invoicing.

Additional Features: Beyond Invoices

Expense Tracking and Accounting

FreshBooks offers simple expense tracking and basic reports—great for solo freelancers who just want to know where their money’s going.

QuickBooks gives you full accounting features, like:

- Double-entry bookkeeping

- Tax deduction reports

- Mileage and inventory tracking

- Detailed cash flow analysis

If you’re already worrying about tax season, QuickBooks can save you serious headaches.

Mobile App Capabilities

Both apps are highly rated for mobile, but here’s how they differ:

- FreshBooks Mobile: Ultra-simple for sending invoices, tracking time, and recording expenses.

- QuickBooks Mobile: Adds deeper accounting on the go—great if you need to categorize expenses or run reports anywhere.

If you’re constantly traveling or working from cafes, FreshBooks’ simplicity can feel like a lifeline.

Ease of Use and Customer Support: Will You Get Stuck?

FreshBooks is known for being friendly and approachable—even if you’ve never used invoicing software before. Its step-by-step wizards and clear dashboards reduce overwhelm. Their award-winning support team offers quick, personal help.

QuickBooks has a learning curve because of its powerful accounting features. Tutorials help, but it can still feel intimidating if you just want to invoice. Support is decent but varies by plan level.

Pros and Cons: Summing Up the Strengths and Weaknesses

FreshBooks Pros

✅ Easiest setup for beginners

✅ Beautiful, professional invoices

✅ Supportive customer service

✅ Automated reminders reduce late payments

FreshBooks Cons

❌ Lacks advanced accounting features

❌ Premium plans can get pricey as you add clients

QuickBooks Pros

✅ Powerful accounting functions

✅ Scales well if your business grows

✅ Excellent for freelancers needing detailed financial insights

QuickBooks Cons

❌ More complex interface

❌ Can overwhelm freelancers only needing simple invoicing

FAQs: Choosing Between FreshBooks and QuickBooks for Freelancers

- Q1. I hate chasing late payments—will FreshBooks or QuickBooks help me get paid faster?

-

A: Yes! Both FreshBooks and QuickBooks offer automatic payment reminders so you don’t have to awkwardly email clients yourself. FreshBooks makes it especially easy to set up recurring invoices with reminders, perfect if you want a gentle nudge sent to clients automatically.

- Q2. I’m overwhelmed by accounting—do I really need something as complex as QuickBooks?

-

A: Not necessarily. If you only need professional invoices and basic expense tracking, FreshBooks is simpler and more intuitive for freelancers. But if you plan to scale or need detailed accounting reports for taxes, QuickBooks can save time in the long run.

- Q3. Which software is easier for freelancers with no bookkeeping experience?

-

A: FreshBooks is often praised for its beginner-friendly interface and step-by-step guidance, so it’s ideal if you’re just starting out or want something that won’t overwhelm you.

- Q4. What if I need to invoice clients internationally—will either software support that?

-

A: Yes. Both FreshBooks and QuickBooks support multi-currency invoicing on higher plans. But if you regularly work with clients abroad, QuickBooks’ advanced accounting tools for international transactions might be a better fit.

- Q5. How do FreshBooks and QuickBooks compare when it comes to mobile apps?

-

A: FreshBooks’ mobile app is known for simplicity—great if you just want to create invoices or track time on the go. QuickBooks’ app offers more advanced features, like categorizing expenses or tracking mileage, but it can feel a bit more complex for beginners.

Write down what stresses you most about invoicing—late payments, confusing expenses, or tax prep—then use these FAQs to see which tool solves those worries best!

Conclusion: Which Invoicing Software is Right for You?

You deserve invoicing software that helps you feel confident, organized, and in control of your freelance income—not one that leaves you feeling lost or stressed.

- Choose FreshBooks if you want easy-to-use invoicing software that helps you look professional and get paid faster—without needing a background in accounting.

- Choose QuickBooks if you plan to expand your freelance business, need advanced accounting tools, or want one place to handle both invoices and tax prep.

Ready to find out which fits your needs best?

Try the 30-day free trial of FreshBooks or QuickBooks today—and say goodbye to invoicing worries for good.